Forex trading is an exciting opportunity for investors to earn profits by buying and selling currencies. However, with the high risk involved in the market, it is crucial to adopt best practices to minimize the chances of losses. In this article, we will explore some of the best practices for forex trading in France using MetaTrader 4.

Develop A Trading Plan – A trading plan is a crucial tool for every forex trader. It outlines the strategies to be used, the goals to be achieved, and the risk management techniques. A good trading plan should also include a timeframe for entering and exiting trades. It is essential to stick to the plan even when emotions and market conditions may tempt one to deviate.

Use Proper Risk Management Techniques – Trading forex involves significant risks, including the potential loss of capital. To mitigate these risks, it is essential to use proper risk management techniques, including stop-loss orders, trailing stops, and position sizing. Traders should also avoid overleveraging their accounts, which can lead to significant losses.

Keep Emotions In Check – Emotions can be a significant barrier to successful forex trading. Fear and greed can lead to impulsive decisions that may result in significant losses. It is essential to keep emotions in check by developing a trading plan and sticking to it. Traders should also avoid trading when they are emotional or under stress.

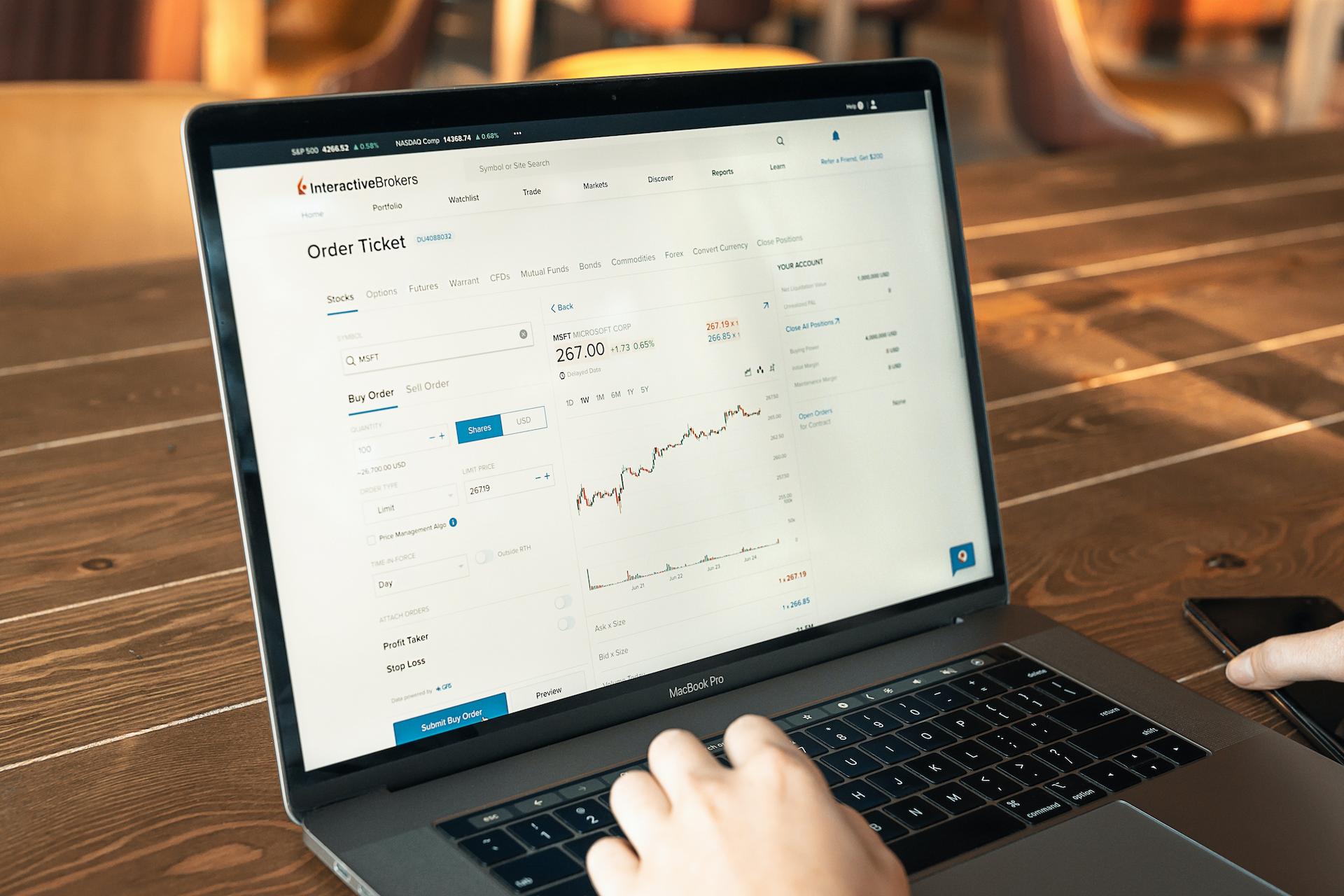

Use Technical Analysis – Forex traders rely heavily on technical analysis as a key trading technique. It entails looking at charts and making use of several indicators in order to recognize trends and possible trading opportunities. Among the many instruments for conducting technical analysis that are included in MT4 are indicators, oscillators, and several charting options. Traders ought to educate themselves on how to make efficient use of these tools in order to locate possible trade settings.

Stay Informed – It is essential to maintain a high level of awareness regarding the most recent news and events that may have an effect on the currency market. Traders who want to be abreast of the most recent happenings can keep an eye on economic calendars and read recent news releases. Traders can benefit from the real-time news feeds and market analysis tools offered by MetaTrader 4, which can assist them in making informed judgments.

Keep A Trading Journal – Forex traders would benefit from maintaining a trading journal as a best practice. Traders are able to monitor all of their transactions, evaluate their performance, and pinpoint areas in which they may make improvements thanks to this tool. Every deal that a trader makes should have its specifics documented, including entry and exit points, the rationale behind the trade, and the results of the trade.

Continuous Learning And Improvement – Because forex trading is a dynamic sector, traders need to consistently educate themselves and develop their abilities in order to be successful. In order to gain knowledge from the experiences of other traders, traders should join in online forums, watch trading seminars, and read trading books. Traders who use MT4 also have access to a broad variety of instructional tools, such as tutorials and demo accounts, which can assist them in becoming more proficient.

To summarize, the implementation of best practices is absolutely necessary for effective currency trading in France. Traders must to establish a trading plan, use appropriate risk management strategies, keep their emotions under control, make use of technical analysis, remain informed, keep a trading record, and continually learn and improve their skills. Traders have a better chance of being successful in the foreign exchange market if they make use of the advanced trading tools offered by MT4 and adhere to the methods recommended below.